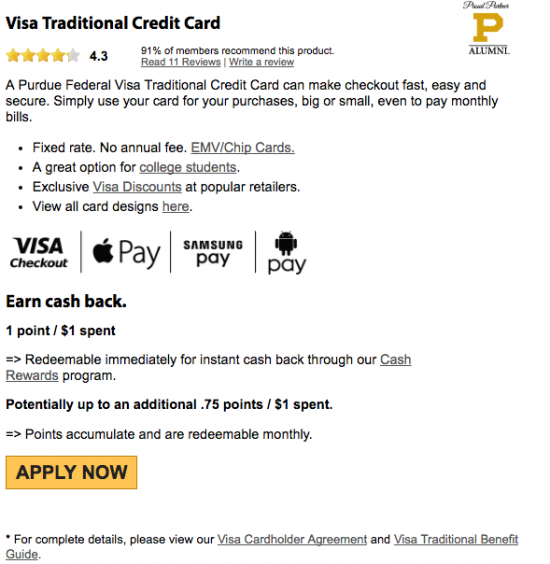

The Purdue Federal Visa Traditional Credit Card is the most basic card on offer from Purdue Federal. It features the variable APR of 11.5% to 17.5% (APR is subject to change) with no annual fee, which is nothing to sneeze at. Included with this offer, the card features a rewards program of 1 point per $1 spent, and an introductory APR of 1.9% for first year after the opening of the account. It is worth mentioning that you may want to see if you qualify for the Purdue Federal Visa Signature Card, as it has more benefits than Purdue Federal Visa Traditional Credit Card at no extra expense. To apply for the Purdue Federal Visa Traditional Credit Card, you can easily see if you qualify by completing an online application through the credit union’s website. We have provided a guide to applying online further down this page.

If you plan on completing an online application, first check out the Purdue Federal privacy notice to see how they protect and use your information.

Requirements

To be eligible for this card you must fulfill the following requirements:

- Be at least 18 years of age

- Have a US SSN

How to Apply

Step 1- Navigate to the Purdue Federal Visa Traditional Credit Card page by following this link and click Apply Now to go to the next step.

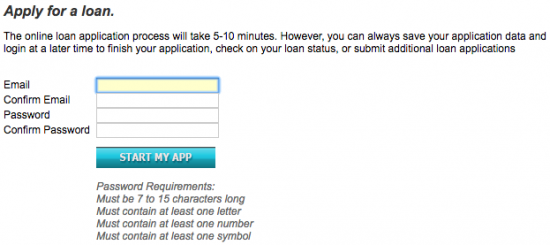

Step 2- In the screen below, enter your Email, then create and enter a Password. Keep this info in case you wish to save and continue your online application at any point. When you’re ready, click Start My App.

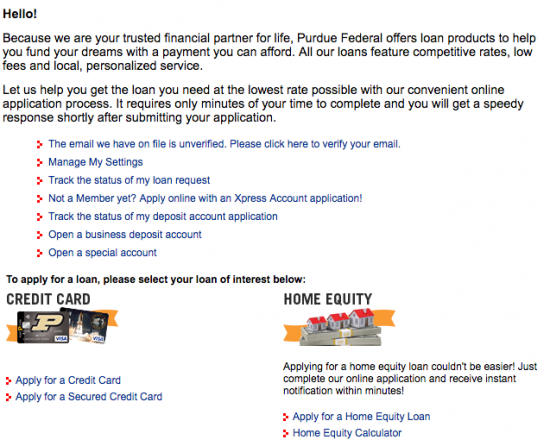

Step 3- Navigate to Credit Card on the next page and click Apply for a Credit Card.

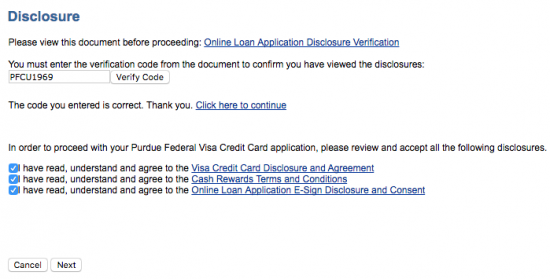

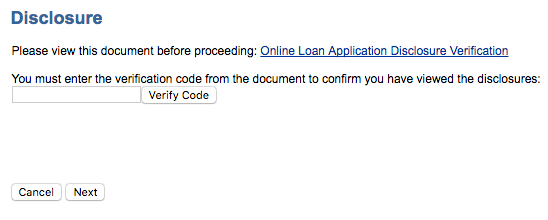

Step 4- Continuing along, click the Online Loan Application Disclosure Verification link seen in the example below, within the linked window you will find a code. Copy this code and paste it in the blank space in the Disclosure section and click Verify Code.

Click the Click here to continue link which will appear, then read and agree to each of the following three linked documents listed below:

Click the Click here to continue link which will appear, then read and agree to each of the following three linked documents listed below:

- Visa credit card disclosure and agreement

- Cash rewards terms and conditions

- Online loan application e-sign disclosure and consent

When you’re finished this, click Next to be able to select your card.

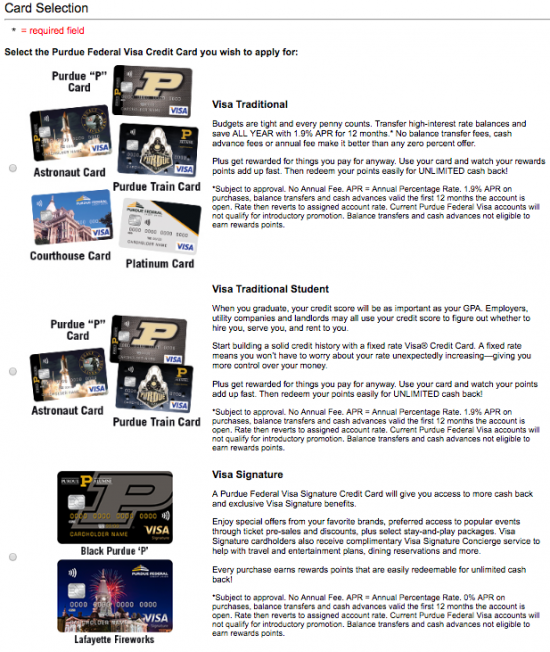

Step 5- On the Card Selection page, select Visa Traditional, and then click Next to start your application!

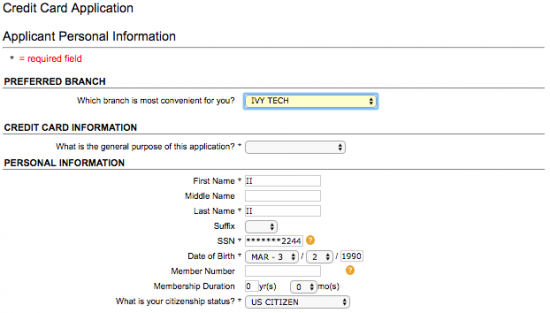

Step 6- Now that you are finally on the Credit Card Application page, you can start by filling it out by providing the following information:

- Preferred branch

- General purpose of this application

- First name

- Last name

- SSN

- Date of birth

- Member number

- Membership duration

- Citizenship status

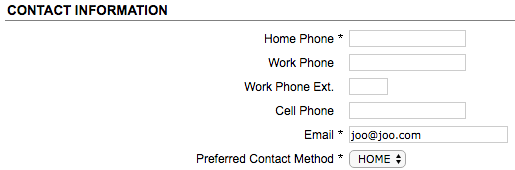

Step 7- Provide the following contact details in the Contact Information field pictured below:

- Home phone

- Work phone (and extension if needed)

- Cell phone number

- Preferred contact method

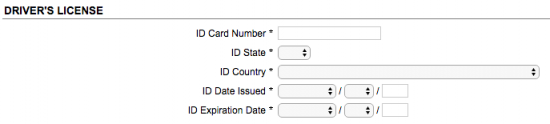

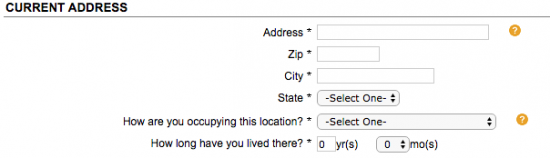

Step 8- Continuing down the application, all of the following items are required information that you must enter in the Driver’s License and Current Address sections pictured below:

- ID card number

- ID state

- ID country

- ID date issued

- ID expiration date

- Address

- Zip code

- City

- State

- Housing status

- Length of time at this location

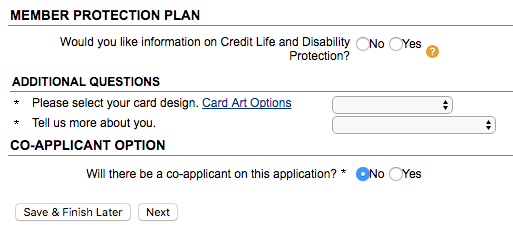

Step 9- In the next three sections, you will have to select different options for your card plan. First, select whether or not you would like to receive information about the Member Protection Plan. Next, select the card design you want, and then select one category that applies to you from the pulldown menu beside Tell us more about you. If you would to add a co-applicant, select Yes in the Co-applicant Option section. If not, leave it selected as No. When this page is completed, you can click Next to get to the next step.

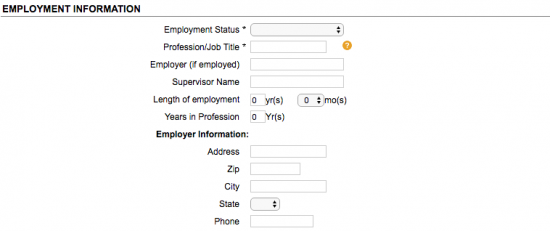

Step 10- On this page, you will have to provide an extensive amount of financial information to help determine your creditworthiness. Start by providing the following Employment Information:

- Employment status

- Profession/job title

- Employer

- Supervisor name

- Length of employment

- Years in profession

- Employer’s complete address (Street address, Zip code, City, and State)

- Employer’s phone number

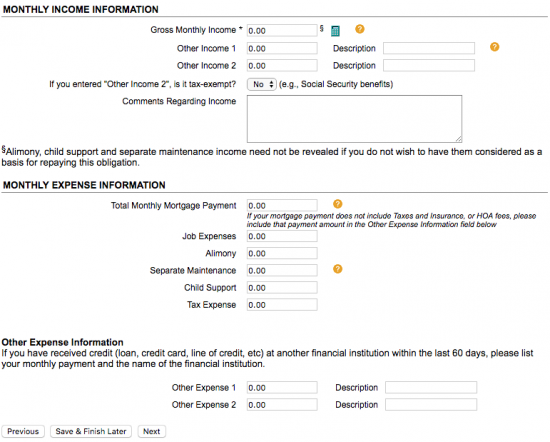

Step 11- Next, in the Monthly Income Information section, enter the following pieces of information:

- Gross monthly income

- Other income (up to 2)

- If other income is tax-exempt

Enter any additional comments about your income situation that you wish to share in the large blank space. Having completed this first section, provide the following expense information as they apply to you and complete the Monthly Expense Information section:

- Total monthly mortgage

- Job expenses

- Alimony

- Separate maintenance

- Child support

- Tax expense

- Other expense (up to 2), if applicable

When you’re finished filling all this information, click Next to proceed to the last step.

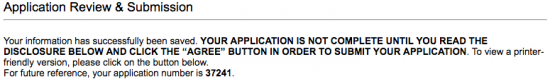

Step 12- Take a moment to check over your application and make sure that you haven’t made any mistakes or left anything out. Save your application number found on the last page of the application in case you need it for future reference.

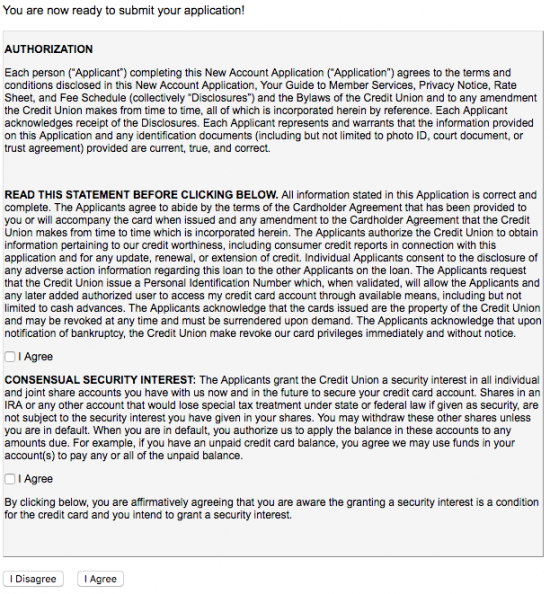

Review the Terms and Conditions for this card and scroll down the page. Look through the three statements in the window, agree to the terms by ticking the two I Agree boxes, and then click I Agree to submit your application.

If you have successfully completed all of these steps, the application process is complete! We hope that our guide has helpful in walking you through your online application. You should soon receive a response from Purdue Federal. Good luck from all of us at cardreviews.org!

If you have successfully completed all of these steps, the application process is complete! We hope that our guide has helpful in walking you through your online application. You should soon receive a response from Purdue Federal. Good luck from all of us at cardreviews.org!