The Belk Credit Card offers a 15% discount on the date you activate your credit card for new members and the ability to earn a $10 reward for every $400 you spend. There is no annual fee and the interest rate is 24.49% for purchases. The lack of cash advances and the fairly high interest rate for purchases makes the Belk Credit Card a difficult card to recommend to those with credit needs. The only thing that makes this card a positive is if your are a loyal Belk customer and are looking to recoup some of the money you spend each month. In this regard, the Belk Credit Card can be a useful savings tool for frequent shoppers.

We highly recommend that all of our readers take a moment to review the online privacy policy as it explains exactly how your personal information is going to be used throughout the application process.

Requirements

To complete the application process successfully, applicants must:

- At least eighteen (18) years of age

- No bankruptcies in credit history

- Has not been denied by Synchrony Bank in the last 6 months

- Resides in USA

How to Apply

Step 1: Click here to visit the Belk Rewards card application page, pictured below.

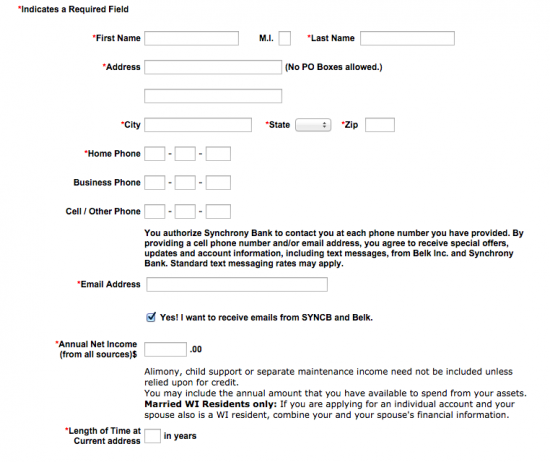

Step 2: The first section of the application will ask for the following basic personal information:

- First name

- Last name

- Address

- City

- State

- Zip

- Home phone number

- E-mail address

- Annual net income

- Length of time at current address

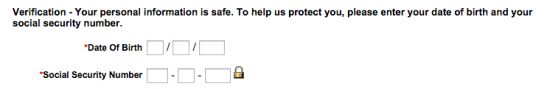

Step 3: Enter the following information where required:

- Date of birth

- Social security number

Step 4: The fourth portion of the application is the optional card security service. If you choose to sign up for this feature, your account balance of up to $10,000 may be cancelled or your minimum payments may be eliminated in the event of unemployment, disability, hospitalization, a leave of absence from your job, a nursing home stay, or loss of life. The fee for this service is $1.66 per $100 of your card monthly balance.

If you want to sign up for the optional card security service, check the grey “Yes” box to serve as your electronic signature.

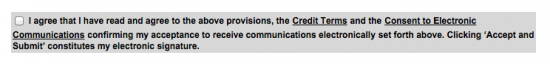

Step 5: Review the credit card terms and conditions, downloading or printing for your records. Check the gray box indicating that you have read and agree to all of the terms outline in the document. Click on the orange Accept and Submit button to complete your application.

Step 6: Click the Accept and Submit button at the bottom of the page to finalize the application process.