How to Apply for the Affinity Credit Union Student Choice Rewards MasterCard

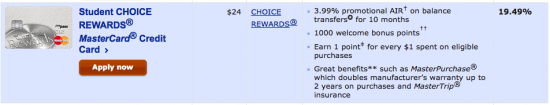

Rate This Credit Card Apply NowThe Affinity Credit Union Student Choice Rewards MasterCard is a viable credit option for individuals enrolled in post-secondary education and for those looking to both create positive credit and accrue valuable reward points. In comparison to a lot of the rewards credit cards that are available on the market, the Affinity Credit Union Student Choice Rewards MasterCard is unique in that the reward points that the individual can earn are not specifically to be used at retailers that the credit union believes students like. For only $24 annually, individuals are able to earn reward points on eligible purchases as well as benefit from a card that offers a competitive interest rate. Individuals looking to apply for this card will find all information necessary by scrolling down to our guide below.

This card has been provided by the Affinity Credit Union and CUETS, a subsidiary to the Toronto Dominion Bank. Before commencing with your application, we recommend reviewing the CUETS privacy policy as they will be handling your card request.

Requirements

In order to apply for the Affinity Credit Union Student Choice Rewards MasterCard, you must meet the following requirements:

- You are a resident of Canada and have a Canadian credit record

- You are the age of majority in your province or territory

- You have not filed bankruptcy in the last 7 years and have no seriously late payments

How to Apply

Step 1- Applicants must begin by navigating to the CUETS webpage which contains a list of each card that they have to offer. Scroll through the list and locate the Student CHOICE REWARDS MasterCard Credit Card. Within the card window, click Apply now.

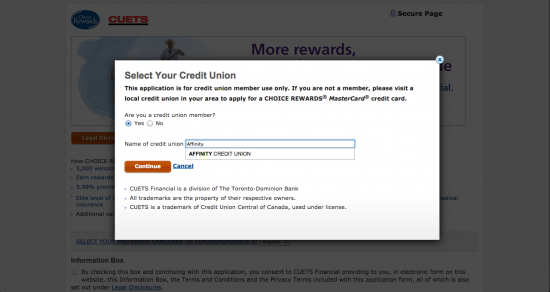

Step 2- A page should pop-up asking you to specify which credit union you are affiliated with. This process can be accomplished by selecting Yes, typing “Affinity Credit Union” in the space provided and clicking Continue.

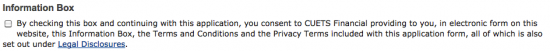

Step 3- Near the top of the page, there is the Information Box heading which contains a small checkable box. Select this box to provide consent to receiving the legal disclosures for this card electronically.

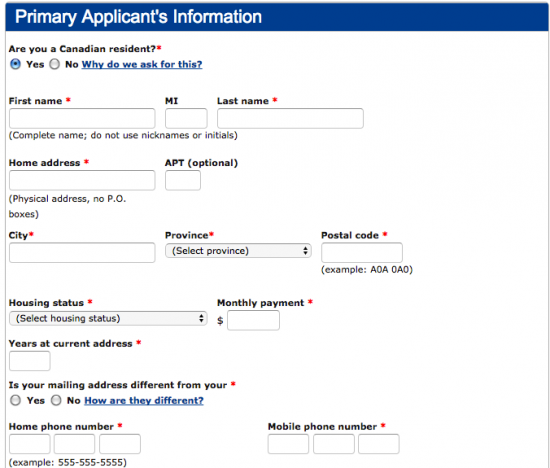

Step 4- Continue down the page until you reach the Primary Applicant’s Information window. There, the following details must be specified:

- Are you a Canadian resident? (y/n)

- First name

- Last name

- Home address

- City

- Province

- Postal code

- Housing status

- Monthly payment

- Years at current address

- Is your mailing address different from your current address? (y/n)

- Home phone number

- Mobile phone number

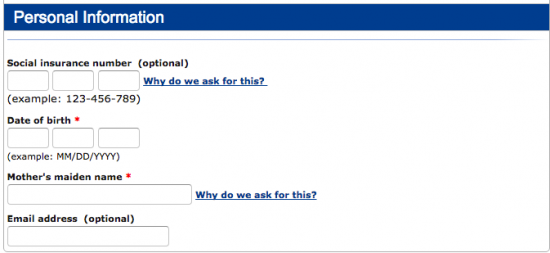

Step 5- Supply your Mother’s maiden name and your Date of birth.

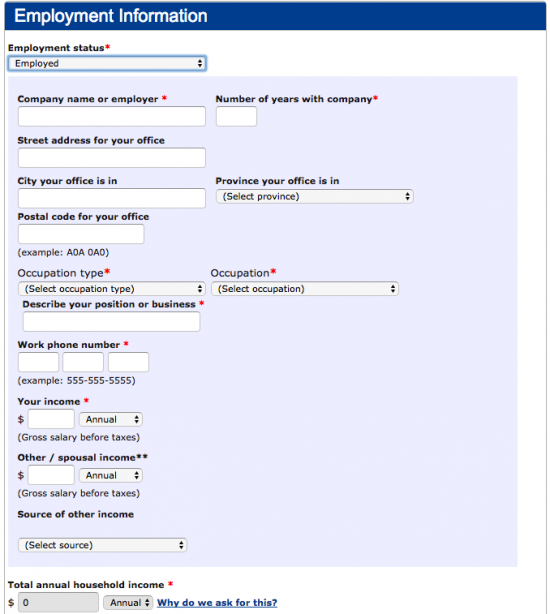

Step 6- Regarding your Employment Information, the data you must supply is as follows:

- Employment status

- Company name or employer

- Number of years with company

- Occupation type

- Occupation

- Describe your position or business

- Work phone number

- Your income

- Total annual household income

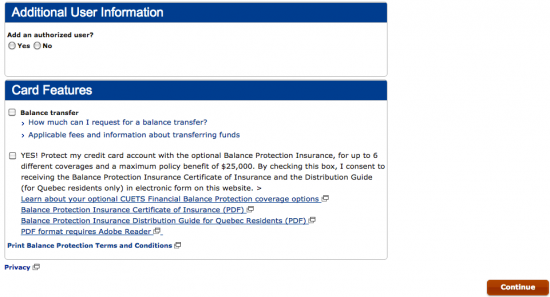

Step 7- At this point, you are able to add an authorized user to your account, perform a balance transfer to consolidate your previous balances and/or purchase balance transfer protection insurance. Each of these tasks are optional and may be skipped. Click Continue when you’re ready to proceed.

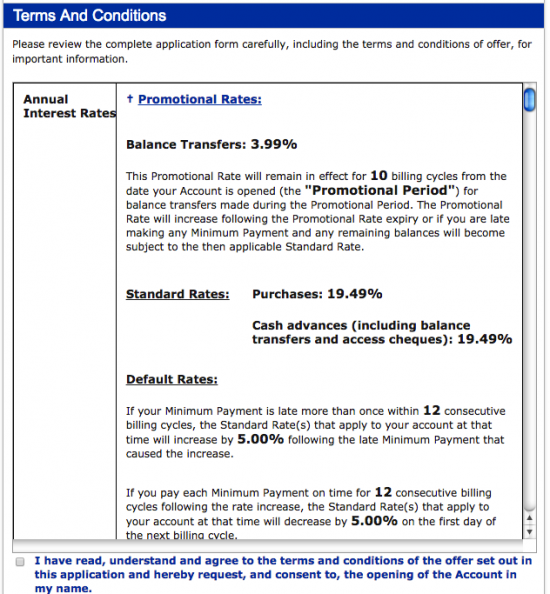

Step 8- CUETS has provided you with a review of the terms and conditions for this credit card, as seen below. We recommend reviewing this document over as it is important to know the rates, fees, regulations, and other terms that determine how your card will operate. If you agree to these terms, check the small box at the bottom of the terms window to provide consent.

Step 9- Lastly, scroll down to the bottom of the page and click Continue to submit your application to CUETS for review, and presto! Your application process is complete and you should receiving confirmation shortly letting you know that they have received your card request.

We here at Card Reviews want to thank you for letting us be your guide through these sometimes troublesome credit card applications. Best of luck with your new card!