The Alliant Visa Platinum Rewards Credit Card is an affordable credit option with a point based rewards program put in place to help you maximize your savings. As with most point based rewards credit cards, the Alliant Visa Platinum Rewards Credit Card will award you with points on a per dollar basis, and for this card you will be awarded with one point for every one dollar spent with the card. If earning points is of little value to you, you might want to take a look at the standard Alliant Platinum Visa Card which has slightly lower interest rates but lacks the ability to earn rewards points. Applying for the card is simple as there is a secure application form hosted on the Alliant homepage. If you are having trouble with the application, please feel free to check out our step-by-step tutorial below.

Make sure you look over Alliant’s privacy policy before you commence with the application to ensure your information remains safe.

Requirements

Applying for this credit card is only possible for members of the Alliant Credit Union. If you are currently a member, the application process is a bit more straightforward. If you have yet to apply for membership, you will become a member in the process. Make sure that at least one of the following requirements applies before proceeding with your application:

- Employee or retiree of a qualifying company

- Member of a qualifying organization

- Live or work in a qualifying Chicagoland Community

- Member of Foster Care to Success

- Relative of an existing Alliant member

On top of the membership requirements, you must also:

- Be at least 18 years of age

- Have a valid SSN

- Be a resident of the United States

How to Apply

Step 1- Start by navigating to Alliant’s card homepage where you are given a variety of details pertaining to the card and its benefits. Access the secure online application by clicking Apply Online.

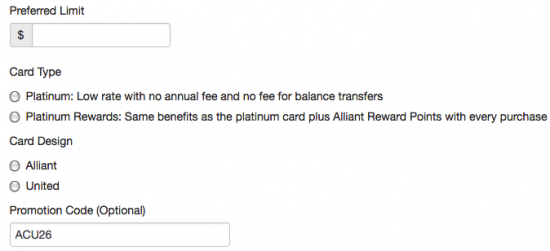

Step 2- With the application on screen, you are asked to specify your Preferred Limit, desired Card Type and Card Design. Below that, you can add your promotional code (if any). Click Continue to proceed.

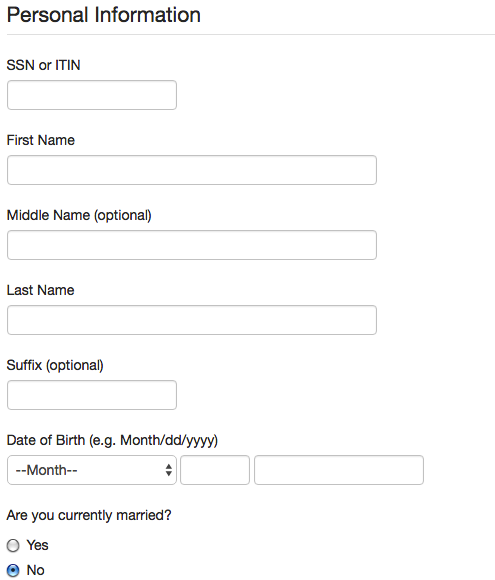

Step 2- This next page is where you will be supplying all of your personal information. To start this process, please provide the following:

- SSN or ITIN

- First name

- Last name

- Date of birth

- Are you currently married? (y/n)

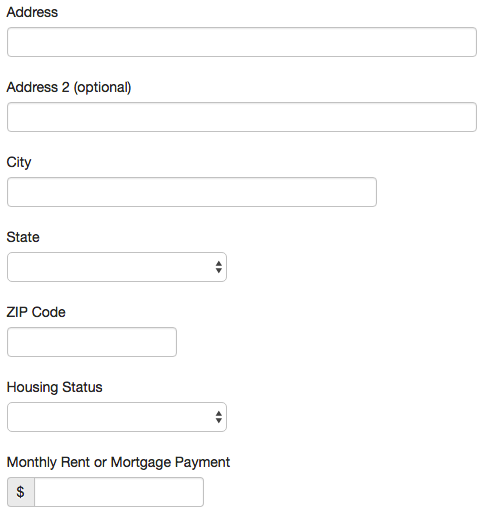

Step 3- Next, you are asked to supply your Address, City, State, Zip Code, Housing Status, and your Monthly Rent or Mortgage Payment.

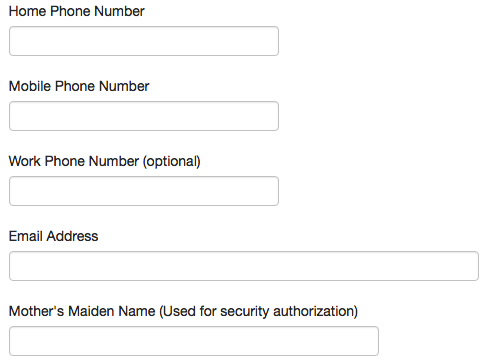

Step 4- Here you will need to give your Home Phone Number, Mobile Phone Number, Email Address, and your Mother’s Maiden Name.

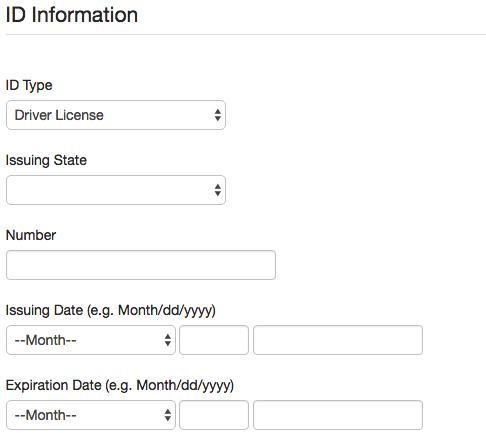

Step 5- The next bit of data that’s required is your identification information. Use the drop-down menus to indicate your ID Type and Issuing State. Just below that, enter the associated card Number, Issuing Date and Expiration Date.

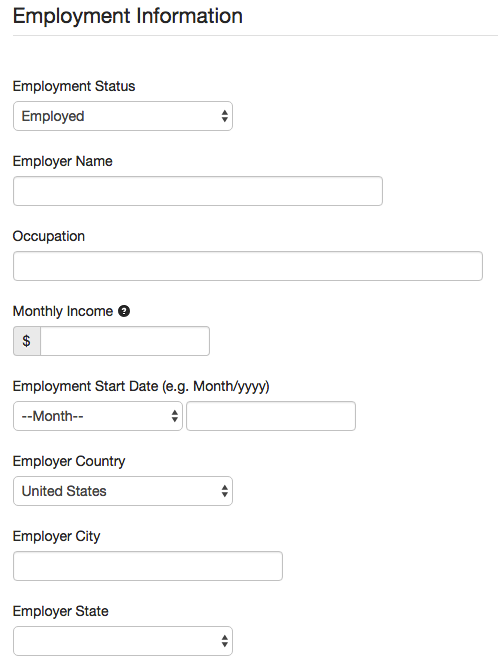

Step 6- You must now give your Employment Information. Specify your Employment Status by choosing one of the options in the drop-down menu. Assuming that you are currently employed, supply the following:

- Employer name

- Occupation

- Monthly income

- Employment start date

- Employer country

- Employer city

- Employer state

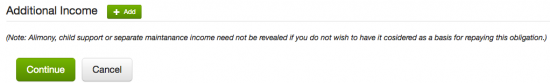

Step 7- At the bottom of the page, provide any information regarding your Additional Income (if applicable). Click Continue when you’re ready to proceed.

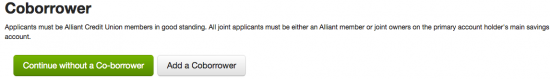

Step 8- A co-borrower, or co-applicant, is an individual who is able to make purchases with your card. If you’d like to add a co-borrower, click Add a Co-borrower and supply the details of that individual. Click Continue without a Co-borrower if you are the only one who is to make purchases with the card.

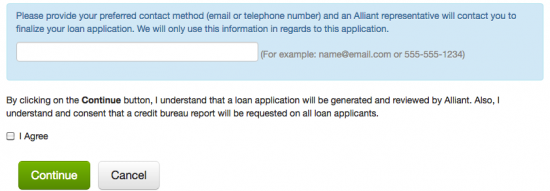

Step 9- There is an empty field on this page in which you must provide your preferred contact method (email or telephone). With that information supplied, your application is one step away from being complete. However, before submitting your card request, take a look at the terms and conditions for this credit card to ensure that you are well aware of what exactly it is you’re applying for. If you agree to these terms, check I Agree to provide consent. Lastly, click Continue and your application will be submitted to Alliant for assessment, and voila! Your application is complete and you should receive notice shortly from Alliant confirming their receiving of your submission.

We hope that this instructional guide has benefited your card application experience. Thank you for supporting Card Reviews and all the best with your new credit card.