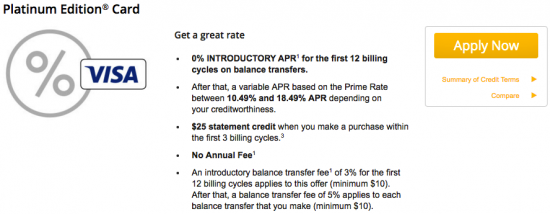

The AmTrust Bank Platinum Visa Credit Card is a great alternative to AmTrust’s Complete Rewards Card. With a significantly lower APR and a similar lack of fees, this card is a good option for people who want to save money without having to do so through a confusing rewards program. Right off the bat, you will receive an introductory 0% APR on balance transfers that will last for your first year of card membership. Your balance transfer fee will also be reduced to 3% of the amount of each transaction and will last for the same amount of time. If you aren’t planning on making any transfers, you should still find some excitement in this card as your interest rate on purchases could potentially be as low as 10.49% (APR is subject to change). Should a rewards program be more suited to your needs, we recommend taking a look at the Complete Rewards Card due to the potential savings being greater, even with the higher interest rates. To find out how you can apply, scroll down to our application guide below.

To ensure that you are comfortable with the way First Bankcard plans on handling your personal information, review the privacy policy. First Bankcard is the financial institution which will be handing your application.

Requirements

Each applicant must meet the following requirements in order to be eligible for this credit card:

- Be at least 18 years of age

- Have a valid US SSN

- Have a valid US street address

How to Apply

Step 1- Begin by finding your way over to the card summary page which details each of the AmTrust credit cards currently available. From there, scroll down until you’ve spotted the Platinum Edition Card and select the Apply Now button to proceed.

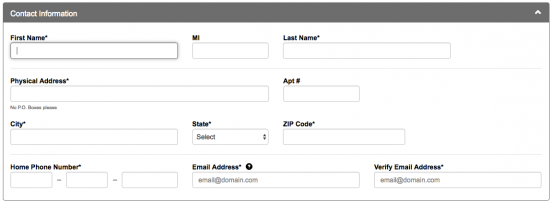

Step 2- On this page, you should see a number of empty fields highlighted with an asterisk. Each of these highlighted fields must be filled in with your personal information. Begin by providing your First Name, Last Name, Physical Address, City, State, Zip Code, Home Phone Number, and Email Address.

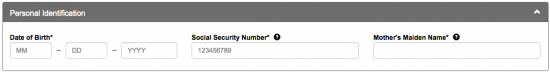

Step 3- Regarding your Personal and Housing Information, please provide your Date of Birth, Social Security Number, Mother’s Maiden Name, Years at Address, Housing Status, and your Monthly Housing Payment.

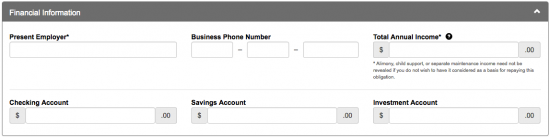

Step 4- Enter the name of your Present Employer and provide the corresponding Business Phone Number. Next, supply your Total Annual Income and, optionally, the total amounts in your Checking Account, Savings Account, and Investment Account.

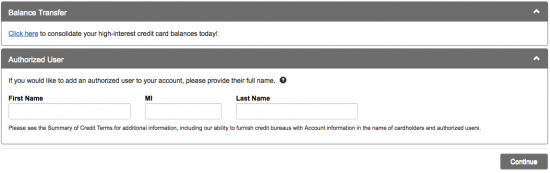

Step 5- If you’d like, you may take this opportunity to perform a balance transfer to consolidate your previous card balances into one single bill. You may also add an authorized user to your account; an authorized user is an individual other than yourself, who is able to make purchases with the card. Click Continue when you’re ready to proceed to the next step.

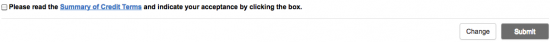

Step 6- Here on this last page, you are able to review all of the information you’ve supplied in your application. Make sure your data was provided correctly before scrolling down to the bottom of the page. You should see, at the bottom of the page, a small selectable box (pictured below) that must be checked in order to provide consent to First Bankcard’s terms and conditions. We encourage you to read the terms and conditions document over carefully to ensure that you agree with the rates and fees associated with this particular credit card. If you agree to the terms, check the box and click Submit to have your application sent in to First Bankcard for review. You have now successfully submitted your card request!

Before saying goodbye, we would like to thank you for choosing Card Reviews as your credit card specialist. Take care and best of luck with your new credit card!