How to Apply for the Bank of Edwardsville Visa Business Cash Credit Card

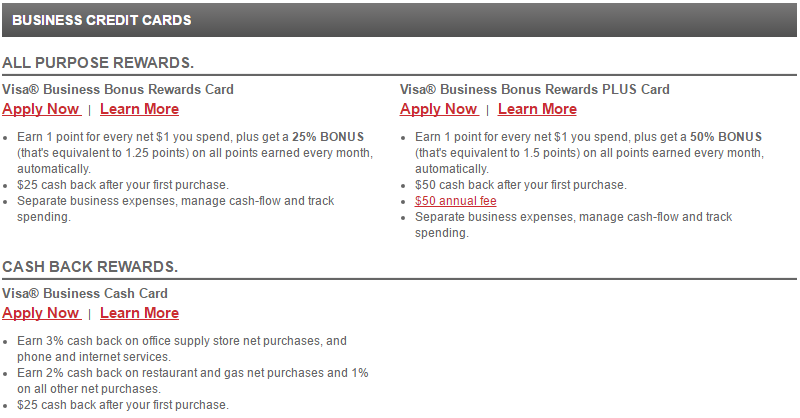

Rate This Credit Card Apply NowFor small business owners looking for a credit card with a standard cash back rewards program, the Bank of Edwardsville Visa Business Cash Credit Card could be the right fit for you. This card offers 3% cash back on purchases made at office supply stores and on phone/internet/TV services, 2% cash back on restaurant and gas purchases, and 1% cash back on all other purchases. There is no limit on the cash back you can earn and you can choose to redeem it as a cash deposit into a separate account or towards a statement credit. Make sure you redeem your cash back rewards within 5 years of earning them as they will expire. There is no annual fee for this credit card and it comes with an interest rate quite common for a rewards credit card of this type (between 12.49% and 23.49%, APR is subject to change). As an added bonus, a 0% introductory APR is applied for the first 6 billing cycles and you will receive a $25 cash back bonus after your first purchase. So if you’re in need of a credit card that won’t cost you anything and provides your business with a little extra cash, apply for the Bank of Edwardsville Visa Business Cash Credit Card today.

Before submitting any personal or financial information into the application form, read through the privacy policy provided by Elan Financial Services (EFS).

Requirements

To be eligible for this particular card, you must meet the following criteria:

- Applicants must be 18 years of age or older

- Applicants must have a valid US address

- Applicants must have a valid Social Security number

- Applicants must have a valid Business Tax ID number

How to Apply

Step 1 – To begin the application process, navigate to the Bank of Edwardsville credit card page on the EFS web portal. Scroll down to the Bank of Edwardsville Visa Business Cash Credit Card and click Apply Now.

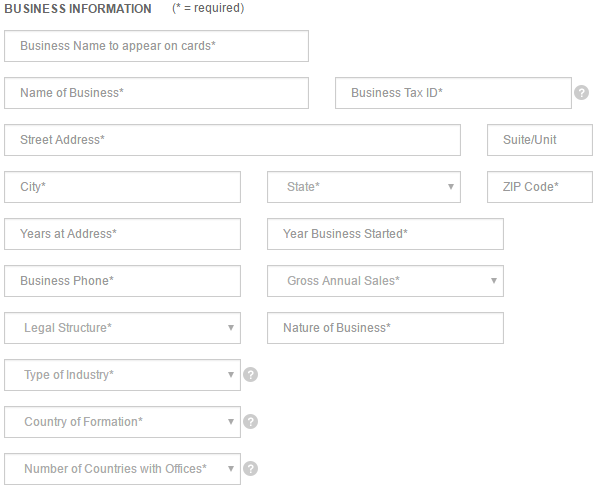

Step 2 – The first section of the application form asks for the following Business Information:

- Business name to appear on cards

- Name of business

- Business Tax ID#

- Physical address

- Years at address

- Year business started

- Business phone number

- Nature of business

- Type of industry

- Country of formation

- Number of countries with offices

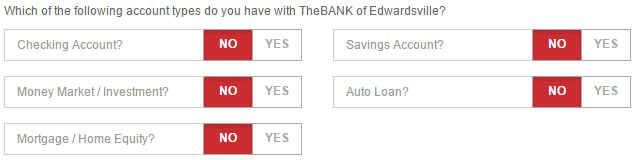

Step 3 – Next, select YES next to any Bank of Edwardsville accounts you currently have open and provide the necessary information for each account.

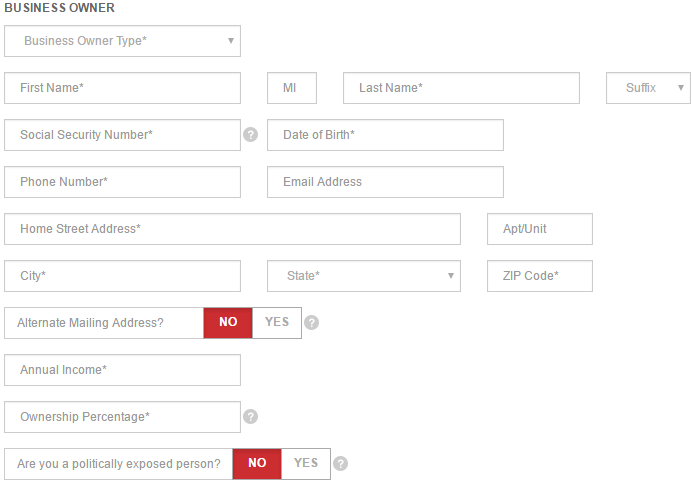

Step 4 – This step involves you entering information pertainig to the Business Owner. Provide the following information into the indicated fields:

- Business owner type

- Full name

- Social Security number

- Date of birth

- Phone number

- Email address

- Physical address

- Annual income

- Ownership percentage

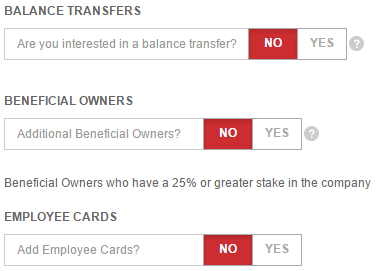

Step 5 – At this juncture, you are given the opportunity to make a balance transfer, add beneficial owners to the account, and opt for additional employee cards. If you’d like to make a balance transfer, select YES and provide the amount of the transfer. If anyone has a 25% or greater stake in the company, they are a beneficial owner. Select YES if there are additional beneficial owners and provide the necessary information. Lastly, select YES next to Add Employee Cards? if you would like to designate any employees to receive additional cards and enter their names, employee numbers and dates of birth.

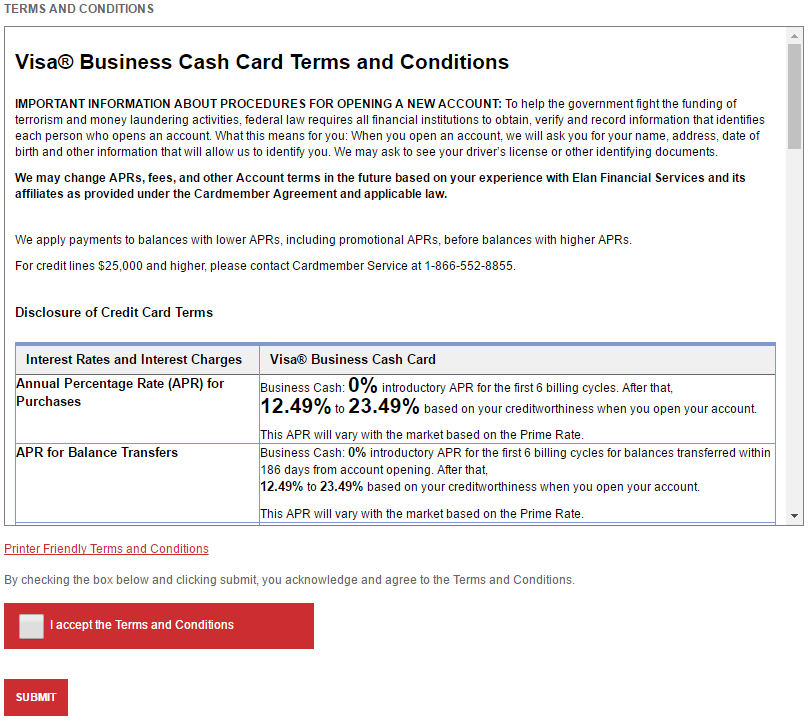

Step 6 – The last step of the application process asks that you read the terms and conditions and tick the box at the bottom beside I accept the Terms and Conditions. Click SUBMIT once this step has been completed.

Now all you have to do is sit back and wait for EFS to review your application. We hope these instructions were helpful and hope that your application is successful. Good luck!