If you live in New York and you’re having trouble acquiring a credit card, you may want to consider applying for the New York Community (NYCB) Bank Secured Card. With no annual fee and an APR of 20.24%, it is slightly better than most secured credit cards out there (APR is subject to change). It is almost impossible to be turned down when you apply for a secured credit card. Instead of your acceptance being based on your creditworthiness, you will have to make a safety deposit from your checking or savings bank account. For this credit card your credit limit will be established as 10% less than your deposit amount. If ever you are behind in paying off your statement, the bank will have the right to withdraw from your security deposit, ensuring that your credit score remains unscathed. Are you interested in the NYCB Secured Card? We have provided a guide below which takes you through all the steps of applying for this credit card online. Scroll down and follow the instructions below if you’d like to apply today.

This credit card is issued by a third party, First Bankcard (a division of the First Bank of Omaha). Before you continue, we recommend that you read through their privacy policy to see how they use their clients’ private information.

Requirements

Applicants must meet the following requirements to be eligible for this credit card:

- Be at least 18 years of age

- Have a valid SSN

- Have a valid US mailing address

- Make a security deposit of $300-$5,000

How to Apply

Step 1 – To start, navigate to the NYCB credit card page by following this link. Once you’re there, locate the Secured Card summary and click the Apply Now link to access the application form.

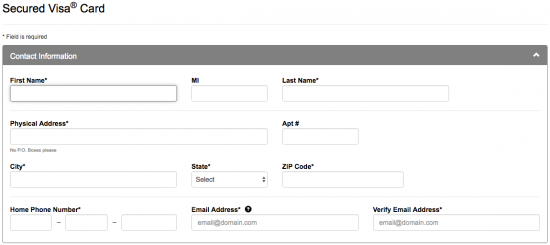

Step 2 – Now that you’re looking at the application form, begin by filling out the Contact Information section with the following information:

- Full name

- Physical address (including city, state and ZIP code)

- Home phone number

- Email address

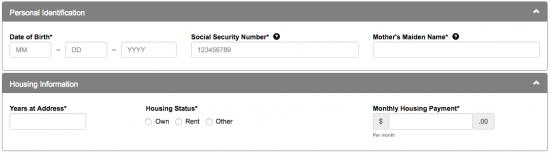

Step 3 – Next, you will be asked to provide the below information into the indicated fields of the Personal and Housing Information sections:

- Date of birth

- SSN

- Mother’s maiden name

- Years at address

- Housing status

- Monthly housing payment

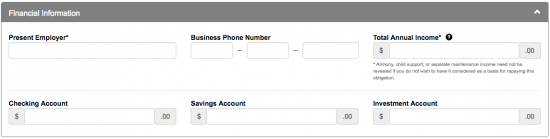

Step 4 – In this step, you will be asked to provide the following employment and financial information into the Financial Information section:

- Present employer

- Business phone number (optional)

- Total annual income

- Checking account balance

- Savings account balance

- Investment account balance

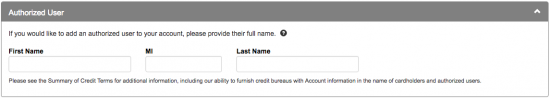

Step 5 – You have the option to add an additional cardholder to your account. To do so, provide their full name in the Authorized User section.

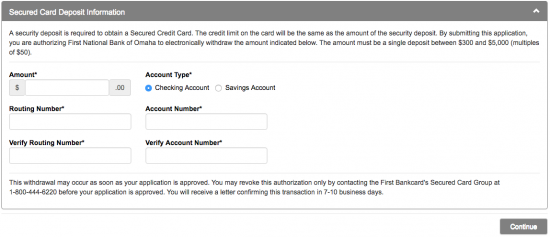

Step 6 – To be able to open a secured Visa account, you will be required to supply the following information regarding your security deposit before clicking Continue:

- Amount ($300-$5,000 in multiples of $50)

- Account type

- Routing number

- Accounting number

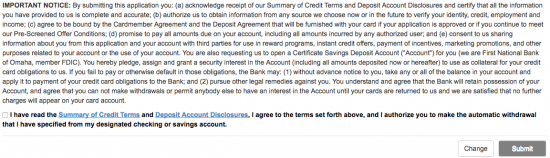

Step 7 – Review your application for accuracy and look over the terms and conditions to be sure that you agree with them. If you agree to the terms and conditions, check the I have read the Summary of Credit Terms box and click Submit to finish your application.

Now that your application is finished and submitted for review, you need only wait for the response to see if your application is accepted. We hope that you have found this guide helpful and we wish you the best of luck in all your financial endeavours.