When compared to other platinum cards, the Sandy Spring Bank Platinum MasterCard isn’t very remarkable. It’s a pretty underwhelming credit card, with no rewards program, an average APR and almost no perks attached to it at all. The perks that this card does offer are quite dissatisfying, but might peak the interest of a few people. A $25 statement credit is rewarded after the user makes their first purchase (as long as it’s within the first 3 billing cycles) and an introductory APR of 0% is offered for the first 12 billing cycles on balance transfers. Keep in mind that, despite there being no interest on balance transfers, a transfer fee will be applied to each transaction, starting at 3% for the first 12 billing cycles, then going up to 5% after that. The purchase APR for this card is, like we said, average. However, those with excellent credit score could be seeing interest rates as low as 10.24%. Anyone with average or poor credit, will be seeing a higher APR anywhere up to 18.24% (APR is subject to change). If you’re still set on applying for the Sandy Spring Bank Platinum MasterCard, we’d be glad to guide you through the application process. Follow our short tutorial below to apply for this credit card today.

It would be in your best interest to read through First Bankcard’s privacy policy to better understand how they might use your information in the future.

Before applying for this credit card, make sure you meet the following criteria:

Step 1 – To get started, follow this link to the Sandy Spring Bank personal credit card page. Below the image of the card is an Apply Now button. Click on it and you will be redirected to a First Bankcard page (the card-issuing company. If you get a pop up notice disclaiming your redirection from the Sandy Spring Bank website to the First Bankcard website, it is safe to click Yes to continue. If you aren’t able to get to the First Bankcard page, it may be because the pop-up blocker on your internet browser is blocking it. “Allow pop ups” for this website in order to continue the application process.

Step 2 – On the First Bankcard page, find the Sandy Spring Bank Platinum MasterCard and click the Apply Now button next to it.

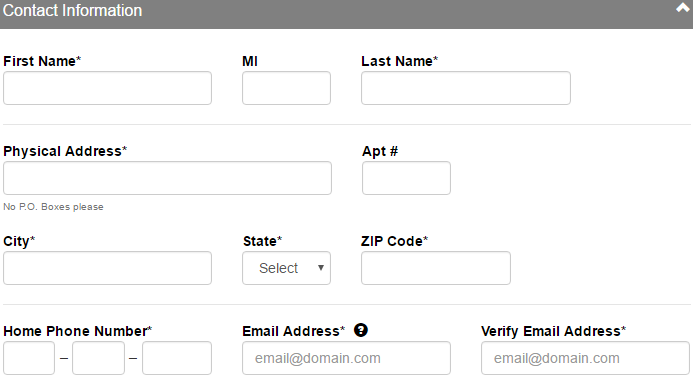

Step 3 – You should be seeing an application form in front of you. Begin filling out the form by entering the following information:

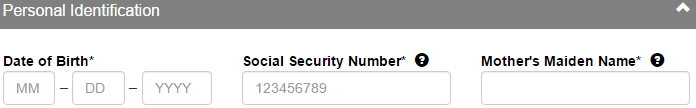

Step 4 – Next, you are required to confirm your identity by providing your Date of Birth, Social Security Number and Mother’s Maiden Name.

Step 5 – They also ask that you provide some information on your current dwelling, such as Years at Address, Housing Status and Monthly Housing Payment.

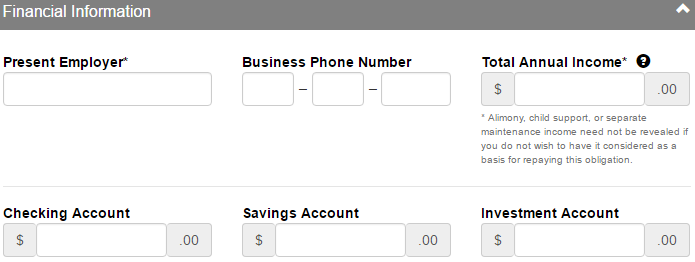

Step 6 – To ensure your eligibility for this credit card, enter the following financial information in the appropriate fields:

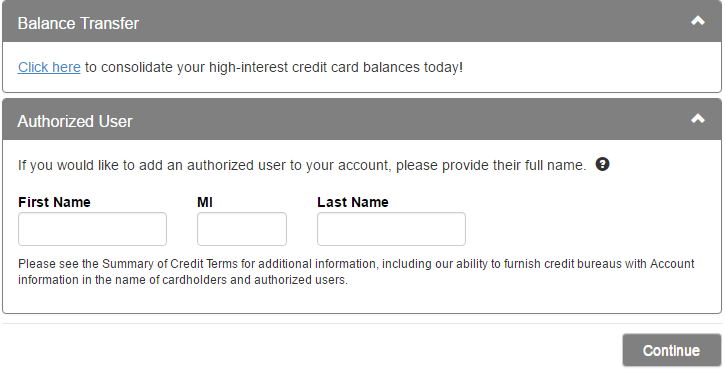

Step 7 – These last couple of steps are optional. If you would like to make a balance transfer, you may do so at this juncture by entering the appropriate information for each transfer (up to 3). You may also add an additional cardholder to the account by entering their full name. Skip these two steps if they do not apply to you. Click Continue once you are satisfied with all the information you have entered.

The application form is now complete. Make sure to read through and accept the terms and conditions before submitting your application for approval. Best of luck in your future endeavors!

How to Apply for the Sandy Spring Bank Complete Rewards Card

How to Apply for the Sandy Spring Bank Complete Rewards Card

Sandy Spring Bank Complete Rewards Card Login | Make a Payment

Sandy Spring Bank Complete Rewards Card Login | Make a Payment