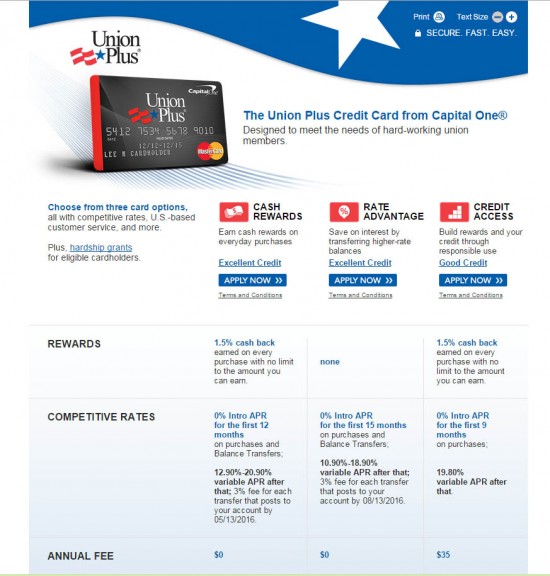

If you are a union member in good standing, the Union Plus credit card lets you effectively manage your finances. There are three different card types available, depending upon your creditworthiness.

Requirements

To receive a Union Plus credit card, you must meet the following requirements:

- Be at least 18 years of age.

- Have a valid Social Security number.

- Be a union member in good standing.

- Have either good or excellent credit.

How to Apply

Step 1 – Visit the credit card welcome screen to learn more about the different types of cards offered. Decide which card you want to apply for and click on the blue “Apply Now” button. (In most cases, the Credit Access program for people with good credit is suitable.)

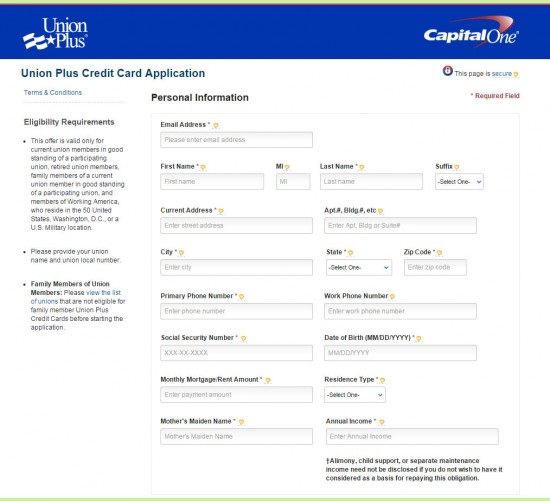

Step 2 – Provide your email address and full legal name. Enter your mailing address. Provide a primary phone number and a work phone number.

Verify your identity with your Social Security number and date of birth.

Provide your monthly mortgage/rent amount and residence type. List your mother’s maiden name and annual income.

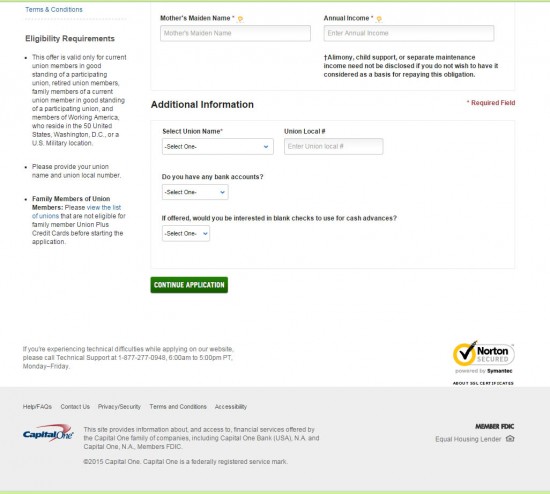

Step 3 – Enter the name of your union and your union local number.

List the types of bank accounts you have: checking, savings, both, or neither.

Decide if you are interested in receiving blank checks to use for cash advances.

Click on the green “Continue Application” button. This will take you to a page that asks you to verify your information and review the account terms before submitting your application for final processing.