Hello and welcome to Card Reviews’ instructional guide covering the Houston Texans Extra Points Credit Card application process. This credit option is perfect for football fans as it comes equipped with a rewards program centered around NFL related purchases; when using your card to buy game tickets, team merchandise or any other qualifying products, you can earn 2 points for every $1 spent. Since you won’t always be buying expensive tickets or NFL merchandise, Barclaycard has provided an additional 1 point per 1$ spent on all other purchases. Based on your creditworthiness, your APR will be either 15.24%, 20.24% or 25.24%, which is slightly above the norm compared to other cards on the market (APR is subject to change). However, there are a few extra bonuses which may provide incentive for those prospective card owners who are currently on the fence. You will receive special financing on ticket purchases, an introductory 0% APR for 15 months on balance transfers made within the first 45 days, and you can earn 10,000 points when you spend $500 within the first 90 days. If these features have caught your eye, scroll down to learn how you can apply today!

Before proceeding, take a moment to review Barclaycard’s online privacy policy to see how your personal information will be used.

Requirements

In order to be eligible for this credit card, the following requirements must be met:

- You are at least 18 years of age

- You reside in one of the approved US states

- You have a valid SSN

How to Apply

Step 1- You may begin the application process by navigating to this webpage. There you should see the NFL Extra Points Credit Card. Just above that on the right, select the Apply tab to proceed.

Step 2- Just below the Carry Your Team Everywhere heading, use the drop-down menu to select Houston Texans from the list of available options. Click Apply Now after making your selection.

Step 2- Just below the Carry Your Team Everywhere heading, use the drop-down menu to select Houston Texans from the list of available options. Click Apply Now after making your selection.

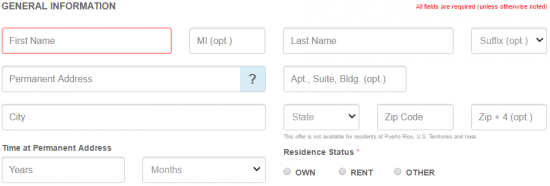

Step 3- Here you are required to provide some basic personal information. The following details must be specified:

- Name

- Permanent address

- Time at permanent address

- Residence status

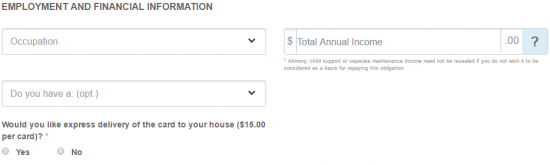

Step 4- Concerning your Employment and Financial Information, specify your Occupation and your Total Annual Income. Just below that, indicate whether or not you’d like to expedite the delivery of your card by selecting Yes or No.

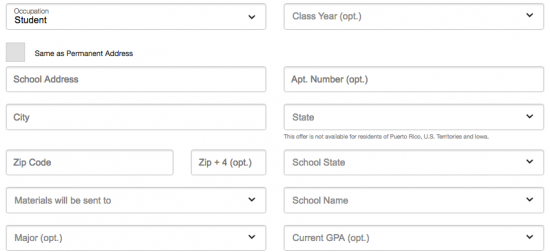

If you are currently a student, some additional information is required. Specify the following details:

- Class year

- School address (street, city, state, zip)

- School state

- Materials will be sent to? (permanent address or address at school)

- School name

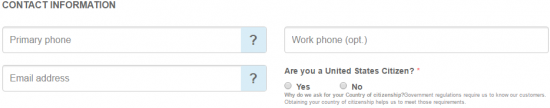

Step 5- Next, enter-in your Primary phone number and your Email address. Before proceeding, select Yes or No to indicate whether or not you are a US citizen.

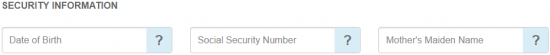

Step 6- At this juncture, you are asked to provide some Security Information. In the entry fields, enter your Date of Birth, your Social Security Number, and your Mother’s Maiden Name.

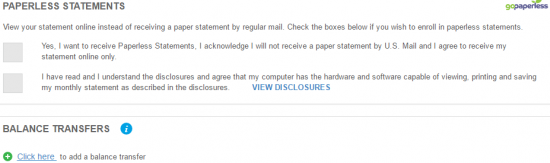

Step 7- To receive your bank statements electronically as opposed to through the mail, review the paperless statement disclosure and check each of the boxes found in the Paperless Statements window. You may also perform a balance transfer to consolidate your previous balances into a single bill.

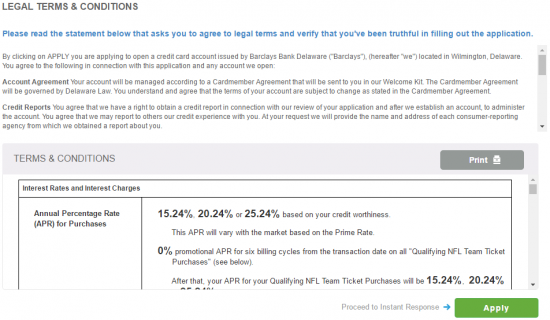

Step 8- In this last step, review the terms and conditions for this credit card and click Apply. Confirmation will be given on the following page regarding the approval of your card request.

Thank you for choosing Card Reviews as your credit card expert. We wish you the very best in all your future banking endeavours. Take care!