The Minnesota Vikings Extra Points Credit Card is a good choice for candidates with a good credit score who also happen to be huge Minnesota Vikings fans. Cardholders enjoy 20% off all purchases at NFLShop.com, and 2 reward points for every dollar spent on NFL tickets, NFL store and on other NFL-related purchases. They also receive 1 point per dollar on all other purchases, and 10,000 bonus points after their first $500 in purchases made within the first 90 days of the account opening. Unlike many other rewards credit cards, there is no limit on the rewards points accumulated with this Visa and they never expire. This means that you can build up your rewards for as long as you want to without worrying about them going to waste. The APR for the Minnesota Vikings Extra Points Credit Card varies between three options according to your credit score, from 15.24% up to 25.24% (APR is subject to change). If you have a good credit score and would like to apply for this card, scroll down this page and consult our online tutorial. The step-by-step walkthrough provided below will take you through all the steps of applying for the Minnesota Vikings Extra Points Credit Card online.

Before you enter any sensitive information on their website, please read the Barclaycard privacy policy.

To be eligible for this credit card, applicants must meet the following criteria:

Step 1 – Start the application process by going to the NFL Extra Points page and clicking the Apply Now link found in the upper right-hand corner of the screen.

Step 2 – Next, select the Minnesota Vikings from the drop-down menu as pictured below and click Apply Now.

Step 2 – Next, select the Minnesota Vikings from the drop-down menu as pictured below and click Apply Now.

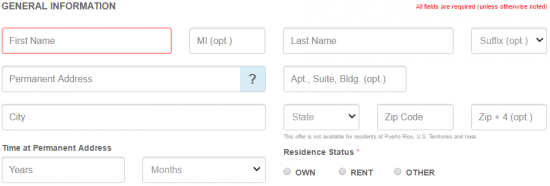

Step 3 – Now begin filling out your application by inputting the following pieces of information as detailed in the General Information section:

Step 4 – As a part of determining your credit worthiness, you will need to provide the following information:

You must also indicate whether you would like to have your card express delivered to your address for a $15 fee.

Step 5 – At this juncture, enter the information listed below into the Contact Information section so Barclaycard can get a contact you:

Step 6 – Next, you must provide your Date of Birth, Social Security Number and Mother’s Maiden Name to ensure the security of your account and your identity.

Step 7 – In this step, you may elect to receive your bank statements online. If you wish to do so, first review the disclosures document, and then check both boxes in the Paperless Statements section. You can also choose to perform Balance Transfers to consolidate your previous balances from other credit cards into a single bill. If you don’t want to perform either of these actions, skip ahead to Step 8.

Step 8 – Your application is complete! Review the terms and conditions and click Apply to have it submitted for approval.

If you have successfully completed all of the steps laid out within this tutorial, you should receive an immediate response from Barclaycard. We wish you the best of luck with your application, and thank you for visiting cardreviews.org!