The Shopko Credit Card is a credit option that might interest those who make frequent purchases at Shopko, whether online or in-store. This card comes with a rewards program which enables cardholders to earn points based on what they spend. If approved for the card, you can earn 1 point for every $1 spent at Shopko. For every 200 points earned, Shopko will provide you with a $10 gift card. The only other bonus provided is a 10% rebate on the first in-store purchase made with your card. While those features may sound enticing, the interest rate on purchases will surely be a deterrent to anyone looking for a card with a reasonable APR. While most cards offer an interest rate based on the applicant’s creditworthiness, this card simply adds 22.49% to the prime rate (the lowest rate of interest at which money may be borrowed commercially), resulting in an APR of 25.99% (APR is subject to change). It is difficult for us to recommend this card due to this unreasonably high interest rate. However, if you find yourself spending hundreds of dollars at Shopko on a regular basis, the points you could potentially earn with this card might deem it worthy of a spot in your wallet. To find out how to apply, scroll down to our tutorial below.

Before submitting any personal information online, we recommend reviewing First Bankcard’s privacy policy.

Requirements

You must meet the following requirements in order to be eligible for this card:

- You are at least 18 years of age

- You reside in the United States

- You have a valid SSN

How to Apply

Step 1- Click here to access the application page for the Shopko Credit Card. Once there, click the Apply Now link to proceed.

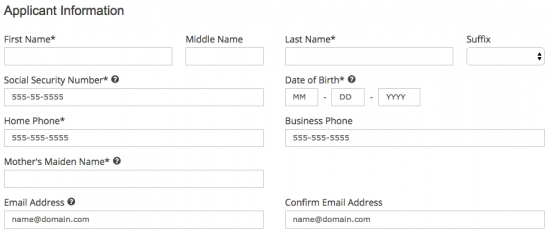

Step 2- This page requires you to specify a number of personal details. Under Applicant Information, enter-in the following:

- First name

- Last name

- SSN

- Date of birth

- Home phone number

- Mother’s maiden name

- Email address

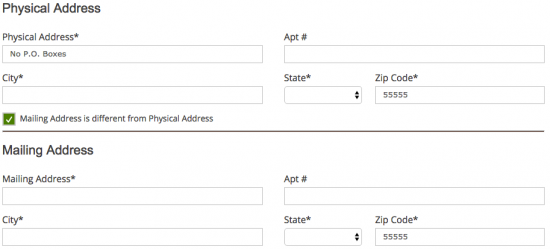

Step 3- Continue by providing your current physical address. If your mailing address is different than your physical address, supply your mailing address as well.

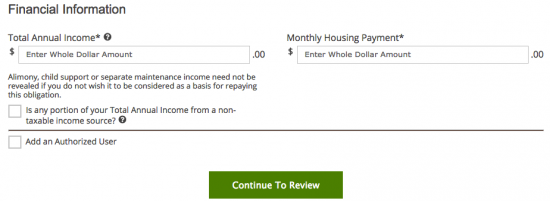

Step 4- In the two entry fields located under Financial Information, supply your Total Annual Income and your Monthly Housing Payment. Just below that, check the small box if any portion of your total annual income is from a non-taxable source of income. At this juncture, you may also add an authorized user to this credit card. Click Continue To Review when you are ready to proceed.

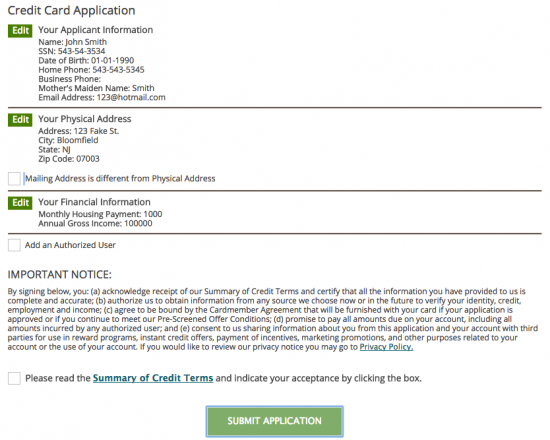

Step 5- This page provides you with a full review of the information you’ve supplied. Before submitting your card request, read over the terms and conditions for this credit card to get a full understanding of what you’re applying for. If you are in compliance with First Bankcard’s terms, check the small box located at the bottom of the page. When you are ready to proceed, click Submit Application to have your card request sent into First Bankcard for review.

We hope you found this tutorial beneficial in your attempt to apply for the Shopko Credit Card. Thank you for choosing Card Reviews and best of luck in all your future banking endeavours!