When you’re sitting high up in the cab of your Ram 1500 you feel invincible, untouchable; like you can’t be pushed around. Ram trucks are built to dominate, rising to every occasion, every challenge and every obstacle you put it through. If you want a credit card that will match the feeling you get when putting the pedal to the metal, you should consider applying for the Ram MasterCard. The rewards program is specifically designed for people who often make FCA related purchases at, where every dollar spent at a qualifying dealership earns the cardholder 3 rewards points. 2 points can be earned on every dollar spent on travel purchases and 1 point per dollar spent on everyday purchases. Points are good for 7 years and there’s no limit to how many points you can earn. Maybe that truck you’ve been eyeing won’t be so expensive after all. Since your truck helps you overcome everyday obstacles, we want to help you overcome the obstacle of applying for this credit card. Below you’ll find a detailed tutorial on how to apply for your Ram MasterCard today.

Before applying, please take a moment to read through the First Bankcard privacy policy (First Bankcard is the issuing company, a division the First National Bank of Omaha).

Requirements

The following requirements are needed in order to successfully apply for this credit card:

- You must be 18 years of age

- You must have a valid US citizenship

How to Apply

Step 1 – We will begin this process by linking the FCA MasterCard homepage. Once the page is loaded you’ll find a section titled Available Cards close to the bottom of the webpage. Click on the Ram MasterCard to continue.

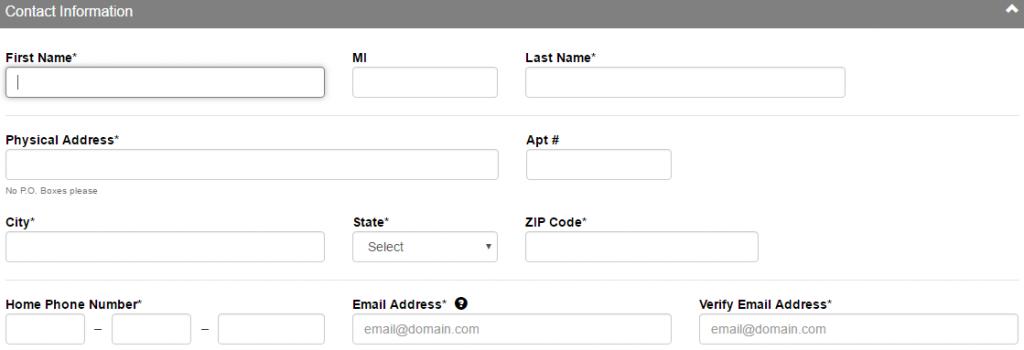

Step 2 – Now you’ll start filling in the necessary fields. The first section asks for the following information:

Step 2 – Now you’ll start filling in the necessary fields. The first section asks for the following information:

- First and last name

- Physical address

- Home phone number

- Email address

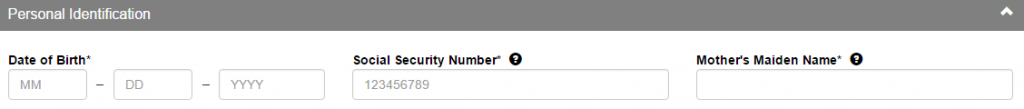

Step 3 – This section requires you to enter your date of birth, social security number and your mother’s maiden name.

Step 3 – This section requires you to enter your date of birth, social security number and your mother’s maiden name.

Step 4 – Next you’ll need to provide your housing information, including years at address, housing status and monthly housing payments.

Step 4 – Next you’ll need to provide your housing information, including years at address, housing status and monthly housing payments.

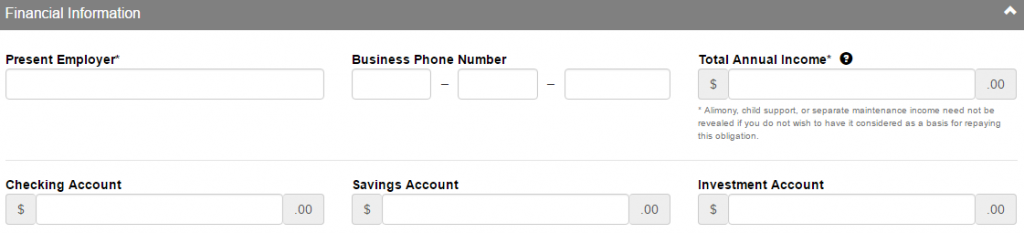

Step 5 – You will need to confirm who your present employer is, their business phone number, and your total annual income. Information about your checking, savings and investment account is optional.

Step 5 – You will need to confirm who your present employer is, their business phone number, and your total annual income. Information about your checking, savings and investment account is optional.

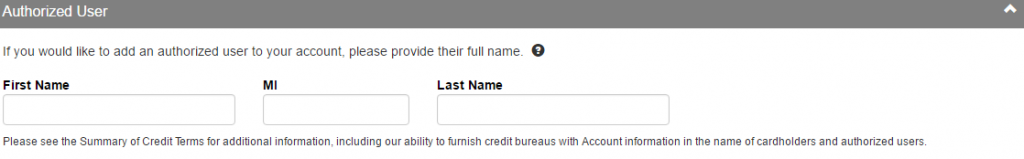

Step 6 – Should you desire to put an additional cardholder on the account you may do so in this section. It is not mandatory, so skip it if you find it does not pertain to you.

Step 6 – Should you desire to put an additional cardholder on the account you may do so in this section. It is not mandatory, so skip it if you find it does not pertain to you.

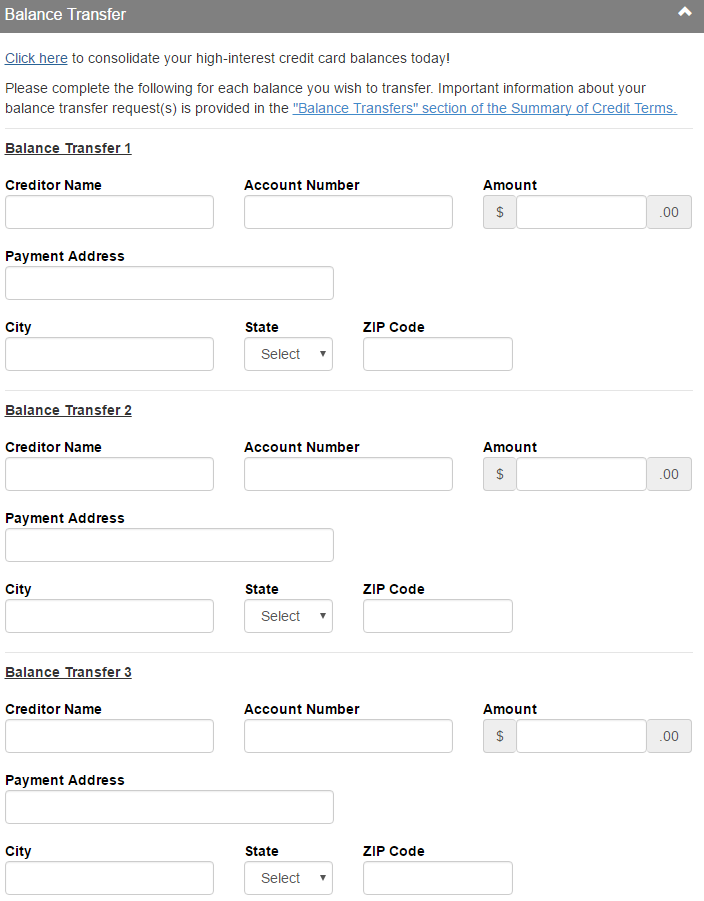

Step 7 – Finally the last step is to enter balance transfer information, should you wish to make one. Again, this step is not mandatory. Once you’ve done this, and read through the terms and conditions, you have finished the application process. Congratulations, we hope your application is successful and that our instructions made this whole activity a lot easier for you.

Step 7 – Finally the last step is to enter balance transfer information, should you wish to make one. Again, this step is not mandatory. Once you’ve done this, and read through the terms and conditions, you have finished the application process. Congratulations, we hope your application is successful and that our instructions made this whole activity a lot easier for you.